- Ubisoft is launching 10,000 NFTs for Captain Laserhawk: The G.A.M.E., offering early access and governance rights to holders.

- Dynamic NFTs evolve with player activity, allowing more influence and rewards as players progress in the game.

Ubisoft launched a 10,000-piece NFT collection on Ethereum scaling solution Arbitrum. Developed in tandem with Magic Eden, this NFT collection relates to Ubisoft’s upcoming game Captain Laserhawk: The G.A.M.E.

Every one of these NFTs provides more than only in-game bonuses. Early access to the game allows holders to affect important areas of its development by means of a governance architecture.

The dynamic NFTs are meant to change depending on the user’s behavior inside the game, so the more a player interacts, the more rewards and influence they can get.

Players have special benefits when their “Eden Score” rises, therefore confirming their place in the network of the game. This technique offers a degree of connection and ownership not usually available in conventional gaming.

Ubisoft Embraces Arbitrum for Scalable Web3 Integration

It is noteworthy that Ubisoft decided to introduce these NFTs on the layer-2 Ethereum solution Arbitrum blockchain.

For a big-scale game project like Captain Laserhawk: The G.A.M.E., Arbitrum is becoming well-known for its scalability and efficiency. The participation of Magic Eden also marks the first time Arbitrum has been let to be minted.

Integrating Web3 technologies lets Ubisoft let its user base actively impact the game’s development, therefore promoting a more immersive and community-driven experience.

The success of initiatives like this one could define new benchmarks for how games are created and how users participate in decision-making procedures as Web3 gaming develops.

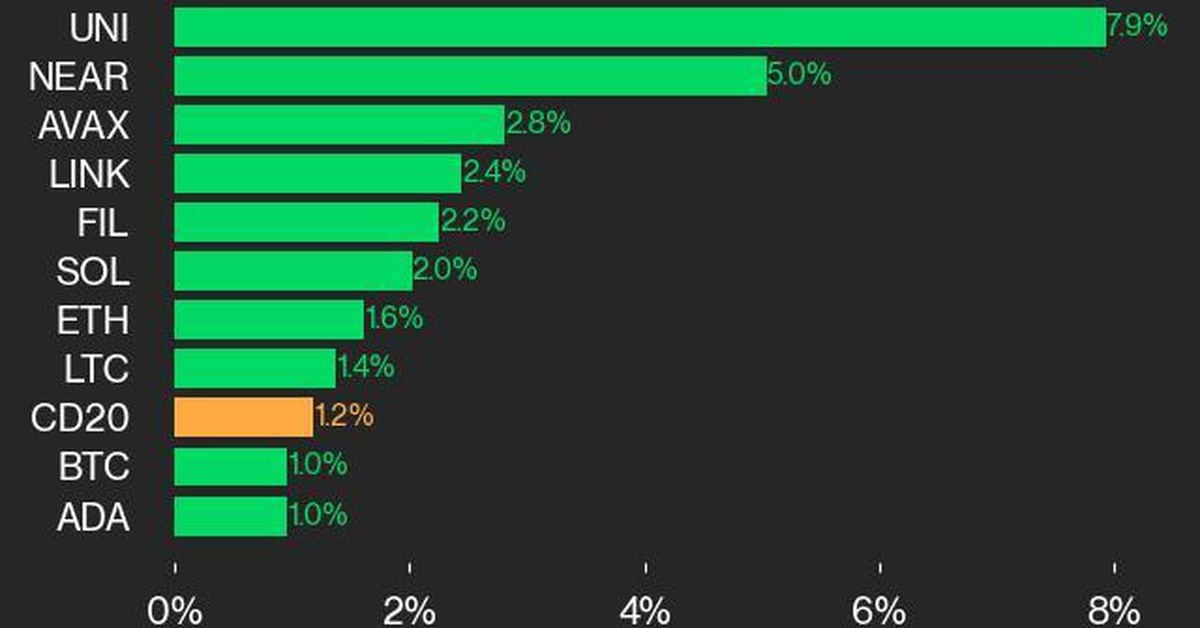

Ubisoft and Magic Eden are entering a really difficult market even if this project is generating great buzz. Recently trading volumes in the NFT and Web3 gaming sectors have dropped; non-Ethereum games especially have suffered.

The trade volume in this industry dropped dramatically in September 2024 compared to other months, which emphasizes the need for innovation and plans meant to spark player interest.